Introduction

Have you ever found yourself on the business treadmill “doing the same thing and getting the same results but expecting and hoping for more”?

Is this perpetuating a state of profitless prosperity?

The point of being in business is to generate a better return on our investment now and in the future, than we can from investing elsewhere.

When our businesses are not returning better than other investments our lives can become very difficult.

Perhaps it’s time to take control of your business destiny!

This article explains the 5 steps that will allow you to transform your business from profitless prosperity to a great return on investment – now and into the future.

The 5 steps to create your money making powerhouse!

The steps are:

- Determine for each product family, product & customer the contribution to ‘fixed cost recovery & profitability’.

- Classify product families, products & customers into separate and distinct portfolio categories.

- Review the products and customers in each category, check out the competitors offering and understand when/if and what actions might be taken.

- Workshop the high priority issues with the senior management team to test various scenarios and agree path forward. Agree process for the other lower priority issues.

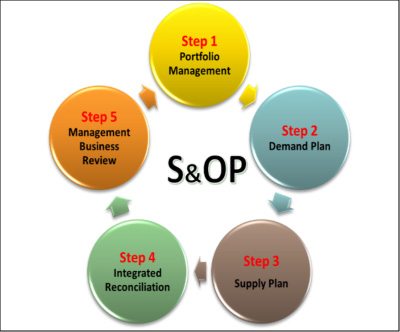

- Incorporate this Portfolio Management Review Process into the organisations’ existing processes, as the first step of your S&OP. (1)

The outcome of these 5 steps is a set of business initiatives including marketing strategies and pricing initiatives which will drive immediate and longer term sustainable profitable growth and as part of your S&OP, enable the delivery of your organisations vision for the future.

Explaining Each Step

1.Determine for each product family, product & customer, the contribution to ‘fixed cost recovery & profitability’.

We are interested in estimating the contribution that each product family, product & customer is making towards fixed cost recovery and profitability. We will use contribution as a simple proxy for profitability.

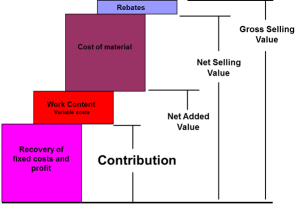

Contribution is defined as the excess of sales price over variable costs and calculated as list price less discounts and rebates, less material costs, less work content such as freight and delivery costs, conversion costs such as direct labour etc (no overheads) and selling costs. What is left is how much this product contributes to the recovery of fixed cost and profit. (Ref Diagram 1.)

We also need to source the expected per annum growth rates for each product family, product and customer over the next 3-5 years.

Note: There is no suggestion to change fixed cost allocations for tax reporting. This is a simple way of discovering to what degree our products and services are contributing to fixed cost recovery and profitability, and if not, what action needs to be taken so that they are.

We will produce the following analyses from this work.

- A Pareto of current Contribution Margin by family, product and customers. (3 Pareto analyses). This will allow easy identification of those product families, products and customers that are golden opportunities and robust money makers, which are profitless prosperity and which are the loss makers on a contribution basis.

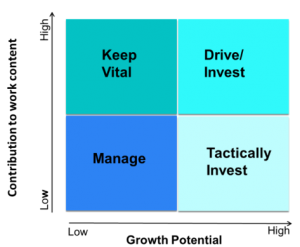

- A Plot of Contribution Margin by family, product and customer on the y axis vs proposed pa rate of growth (next 3 to 5 years) on x axis. (3 charts of CM vs growth).This allows a quick snapshot of the portfolio and where it resides vs our goal of significantly high contribution margin and significantly high profitable growth products and customers into the future. (Ref Diagram 2.)

The goal is to move every product to the top right quadrant of this chart.. The challenge is that this is not always possible with mature products in mature markets hence the need for a portfolio approach which might involve: realising great opportunity for profitability where it resides, and locating the development or emerging products that will be valuable and provide growth into the future.

In completing the analyses note any anomalies which are also opportunities, such as:

- Product family, product and customer business has declined in the last short term, or the industry or market is predicted to decline but Sales and Marketing are predicting growth going forward. Understand their assumed intervention in terms of price, investment, and new products.

- Well known product families, products and customers’ whose profitability is deteriorating or are not even profitable as well as surprise products and customers that are highly profitable.

- Within product families you may find some highly profitable but there are one or two products that are doing all the work, or even one or two who are letting the product families down?

- Can you identify customers buying patterns? Do you see that some customers are buying lots of your products and obviously very loyal, whilst others are just cherry-picking?

2.Classify product families, products and customers into separate and distinct portfolio categories.

As always we will use frameworks to help us focus on those categories of product families, products and customers that add the most value for least effort.

Select a portfolio management framework that suits your business or use the one proposed.

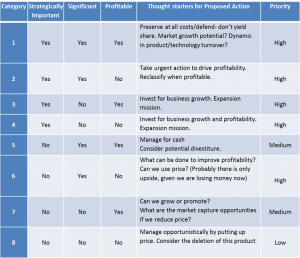

For every product family, product and customer answer the following questions:

- Is this product family, product or customer strategically important?

- Is it significant?

- Is it profitable?

In this process we define the criteria as follows:

- Strategic importance – They are inherently linked to our vision of the future. They are critical to the delivery of our True North in terms of product, association with critical products, and association with specific channels.

- Significance – They are a major part of our portfolio across the board or by specific channels.

- Profitability – They have a positive contribution margin.

3.Review the product families, products and customers in each category, check out the competitors offerings and understand when/if and what actions might be taken.

If product families, products and customers are strategically important then we are going to prioritise these as high and want to work on these first, particularly if they are not profitable.

We may also want to investigate further those product families, products and customers that are not strategically important, but also not profitable. We have also prioritised these as high.

Other categories will be relegated to medium or low priority.(Ref Table 1)

We are keenly interested now in our competitors and their offering and our level of competitiveness with them by product by channel:

- We need to make a physical comparison of our products/or services with our competitors offering. How do we compare in terms of features, benefits, cost of materials, availability delivery, warranties, other?

- We need to also understand market share. Where are we positioned?

We need to understand:

- Where do we need to reduce costs, add new features?

- Where can we use price strategically e.g. to capture profitable market share or reposition unprofitable or profitless prosperity products?

- Where should we use service to lock in profitable customers or force unprofitable customer to the opposition

- Where should we invest to reduce costs?

- Where should we invest R&D to deliver better features and products?

4.Workshop the high priority issues with the senior management team to test various scenarios and agree path forward.(Categories 1 to 4 & 6. ) Agree process for other lower priority issues. (Categories 5, 7 & 8.)

The purpose of the workshop is to develop a set of sales and marketing strategies and pricing initiatives which will drive immediate and longer term sustainable profitable growth.

The outcome of the workshop is agreement to monitor and continue to develop critical actions resulting in improved profitability now and going forward, and establish a more formal regular forum to undertake the review process and ensure that these activities now fit with the rhythm of the business.

In structuring the workshop, start with issues relating to strategically important product families, products and customers by channel, that are not profitable category’s 2 & 4.(Both are strategic and not profitable and high priority) You might then evaluate categories 1 & 3.(Both strategic and profitable). Then consider category 6 which is not strategic, and not profitable but significant.

Eg. For Category 2: Identify product families, products and customers involved. Identify anomalies or opportunities. What are we planning to do to improve profitability? What are the options for consideration? Each scenario needs to be clearly stated with costs, benefits and implications along with our proposed recommendation. Is this where we need to reduce costs and add new features? Is there also an opportunity here to use price strategically e.g. to capture profitable market share or reposition unprofitable or profitless prosperity products?

As we progress this work, we will be able to further summarise these recommendations as:

- Opportunities to better manage the current portfolio (sku, brand, category level) in accordance with business strategy and agreed targets – how profitable, popular and lifecycle management.

- Opportunities to better manage future portfolio in line with business strategy (new product master plan, innovation funnel).

- Opportunities to undertake detailed evaluations of current portfolio vs future portfolio in areas such as Channel, Route to market, Price, Volume, Mix, and Cost.

5.Incorporate the Portfolio Management Review Process into your organisations’ existing processes, preferably as the first step of your S&OP. (1)

The process above is known as the Portfolio Management Review Process. The outcome of this process ensures that the profitability of the business is monitored, protected and enhanced on an ongoing basis.

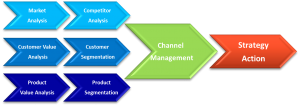

Map and document the steps above with accountabilities and incorporate this process as the first step of your S&OP.(Ref Diagram 4.)

This ensures that the Portfolio Management Review Process becomes part of the organisational ‘rhythm’.

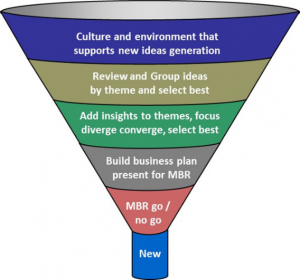

This rhythm includes continually reviewing the portfolio – the project management of new product introductions, product obsolescence and the initiation of an innovation funnel to ensure new products and services are being developed, as and when they should be. (Ref Diagram 5.)

This rhythm means feeding the outcome of the portfolio review into demand plans, checking that the supply chain can deliver to the plan, continuously testing various scenarios to continually course correct, understanding the implications and consequences with regard to the S&OP, the budget and 3-5 year plans and ongoing challenging and refinement of all plans (for instance the capital plan) and subsequent actions.

Note (1) Senior Management must be engaged.

Outcome

Best practice organisations typically incorporate The Portfolio Management Review as the first step of their S&OP process.

The S&OP process then becomes the enabler of the vision for profitable growth and therefor part of the organisations strategic competitive advantage (not just the enabler of day to day operational processes.)

———-

For assistance with creating your money making powerhouse please get in touch with Lisa or Greg West of Farthing West.

Business Connector Rapid Business Growth | Funding | Growth | Grants | Board Members | Business Acceleration Programs | Business Networking — for business owners and entrepreneurs

Business Connector Rapid Business Growth | Funding | Growth | Grants | Board Members | Business Acceleration Programs | Business Networking — for business owners and entrepreneurs